It’s easy to fall into the trap of big promises financial consultants make in Germany. As an expat, I learned to realize for big financial investing decisions, it is better to get into the details. I’ve probably consulted 5+ long-term financial consultants and found Horizon65 the most transparent and honest. So, I thought about writing an honest review.

Here’s why I tried them:

- I was making a good income and wanted a big tax savings, legally.

- I want to make money from ETFs from my pension insurance without paying too much tax.

So, I found Horizon65 because they focus on expats like me.

I used the app to schedule an introduction with a financial expert. It felt less like a formal consultation and more like a conversation with a friend who’s just really good at finance. Their approach wasn’t about overwhelming me with data or jargon but simply understanding where I was and what my situation was and then explaining what options were available to me.

What struck me most about Horizon65 was its transparency and the practical tools it offered. Its app showed me where I needed to be regarding my savings, pension contribution, and investment. Their exceptionally advanced simulator lets you explore how your investments will react in many different scenarios.

I learned that in Germany, you could invest in financial plans that invest in the stock market indexes but have safety mechanisms when the market crashes. These plans also come with tax advantages depending on how flexible you want your investments to be.

In this review, I will share the ins and outs of Horizon65’s service, what sets it apart, and its highs and lows based on my experience. I’ll also share insights from others based on what its users are saying about its ability to provide quality service and client satisfaction. Before we proceed with the review, it is imperative to note that the article is not intended as financial advice or recommendation. The information provided in this article is purely for informational purposes and should not be construed as insurance advice. You should conduct your research and fully comprehend the potential risks involved.

BUT first, full transparency: I may receive commissions if you click on some of the links in this article, but it won’t cost you a thing! Also, the companies do not pay me to write these reviews. I test the products and services myself, and I support them regardless.

Pros

- Honesty and unbiased: Look, everyone’s gonna lure with greed, and nobody’s gonna get into details. Horizon65 folks got in the details.

- Personalized Financial Simulations: Everybody’s situation is different, and Horizon65’s personalized financial simulation tool can accurately reflect your current situation and how that would work out for you in the long run.

- In-house experts: All their experts have significant years of experience and are certified financial advisors. They are able to explain everything in very clear terms.

- Fully independent: Independent from any financial provider, they can compare a broad spectrum of investment opportunities, which are free from any underlying bias towards particular providers.

- Easily compare investments: Once you have set your goals in the app, you can easily compare investments that would reach your goal.

Cons

- No Asset: They do not actually manage the money themselves but rather compare financial investments such as self-managed investments vs. managed investment plans.

- No Crypto Investments: It steers clear of speculative and high-risk investment options, such as cryptocurrencies.

Table of Content

Horizon65 Review: An Overview

Horizon65 is an innovative solution in the landscape of long-term financial planning, particularly in the field of retirement readiness. This platform addresses a critical gap in the German market, where, shockingly, only a tiny fraction of the population has a robust savings strategy.

This platform is rooted in the startling insights from an EU report on pension adequacy and the pressing need for additional savings to prevent widespread financial insecurity. It is more of a mission of the founders to democratize financial planning and empower individuals to secure their financial future.

At its core, Horizon65 leverages advanced technology, profound financial expertise, and a user-centric design to redefine the financial planning experience. The platform isn’t just a silent calculator but a dynamic ecosystem where advanced decision models meet the nuanced understanding of accredited financial advisors.

It acknowledges the complexity and intimidation often associated with financial decisions. To counter this issue, it offers a straightforward, intuitive interface that transforms the challenging task of long-term investment planning into a manageable, even enjoyable journey.

Harnessing sophisticated stochastic finance techniques and comprehensive computer simulations lets the platform present more than generic financial advice. Instead, it delves deep into individual financial situations by scanning the market to identify real, actionable financial options tailored to each user.

Horizon65’s strength lies in its dual backbone of cutting-edge technology and human expertise. This synergy ensures that every piece of advice, every investment option, and every predicted outcome has come through the wisdom and foresight of seasoned financial professionals with the most accurate technologies.

In a nutshell, Horizon65 is a tremendous financial planning tool if you want to thrive on your investment returns. In the next parts of this article, I will take you through how Horizon65 can help you with long-term financial planning with a clear, reliable path to a secure and fulfilling future.

Things I Love

Getting on with Horizon65 turned out to be a game-changer for me in tackling the complex situations of financial planning and investments. This platform has been a mix of a powerhouse of tailored insights, strategic tax planning, and investment flexibility for me.

Its knack for demystifying the tax implications on investments is nothing short of revolutionary. Horizon65 lays out the tax effects and net implications with great clarity to convert the often overwhelming tax landscape into a navigable path toward financial optimization.

Horizon65’s approach to investment flexibility is commendable, as it understands that life isn’t linear and offers investment plans that mirror this reality. Whether it’s a plan that matures when I turn 62 or another that allows for earlier liquidity, Horizon65 respects my need for choices that align with my life’s unpredictability.

Moreover, Horizon65 doesn’t shy away from the bold truth about the ins and outs of investments. By guiding me toward strategically selected ETFs, its people made me explore the investment landscape with an expertise that’s both rare and invaluable. It uses multiple tailored analysis tools to cherry-pick the best available options.

Another thing that impressed me greatly is its transparency and commitment to showing after-cost results strips as sober truth. This level of reliability, coupled with insights into how tax rebates and reimbursements, actually enhance my returns. It feels like I’m getting the most out of every euro invested with them.

The human element of Horizon65 manifested through its accessible team of in-house experts can convert your complex financial planning into a personalized dialogue. It is reassuring to know there’s a team ready to dissect and understand my financial aspirations, offering advice that’s not just algorithmically sound but also humanely considered.

Horizon65 feels like more than a financial planning tool. It has been an active partner in doing the most possible to financially secure the future without the dread of navigating taxes, investments, and retirement planning alone.

Even if Horizon65 does not operate when I retire, I will surely get access to the investments I will make through them. As a result, in a world of financial uncertainties, Horizon65 is the steady hand guiding me toward a future for me and my family that I can look forward to with confidence.

Three Unique Features

Horizon65 distinguishes itself through its cutting-edge offerings and distinctive features. Let’s delve into the three features that truly set Horizon65 apart.

Personalized Investment Options

This feature distinguishes itself by delivering investment recommendations that align individual financial goals and savings capacities. It is also grounded in a thorough, independent market scan that encompasses a wide array of potential investment plans and unbiased representation.

By not being tied to any financial provider, Horizon65 ensures that its recommendations are free from the conflicts of interest that can skew advice in the financial industry. This approach guarantees that users receive advice that is in their best interests based on a comprehensive market comparison.

You can rely on Horizon65 for your suggested plans after taking into account the impact of inflation, taxation, and other critical financial factors.

Simulation Tool

Horizon65’s simulation tool ingeniously combines advanced algorithms with real-world financial data to project future financial scenarios for you. It strives to offer a unique blend of precision, personalization, and predictive prowess to help you understand what you should target with your present saving capacity.

It can detect possibilities and build future scenarios through expert decision models and a comprehensive grid search. The tool then designs decision trees by leveraging the expertise of in-house financial advisors to infer potential financial options based on your simulated personal balance sheet.

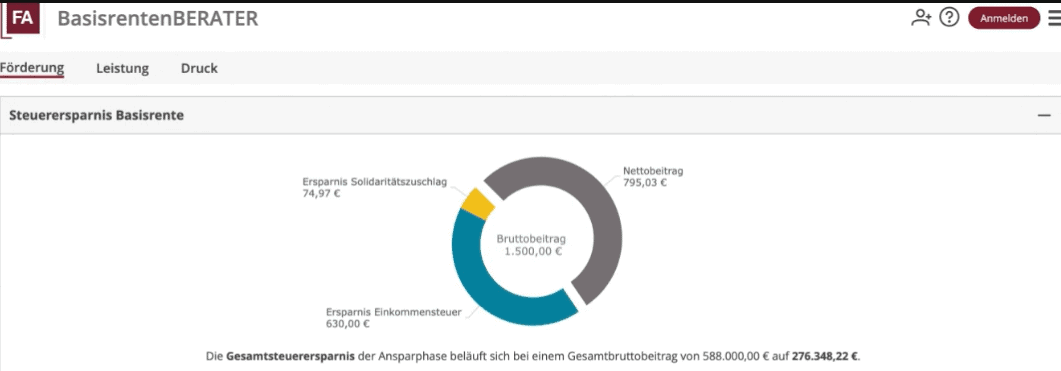

Its user-friendly interface makes complex financial planning accessible to anyone, regardless of their expertise in finance. With it, you can accurately see the amount of tax reimbursement and exemption on solidarity surcharge you can expect because of the investments.

Expert Guidance

The finance experts at Horizon65 significantly enhance the platform’s value proposition by bridging the gap between technology-driven financial planning and personalized expert guidance. It underscores the platform’s dedication to offering the nuanced, empathetic support that can only come from human interaction.

While the technological aspects of Horizon65 offer precision and efficiency in financial planning, human experts add a layer of understanding and personalization that can only be achieved through years of experience in the financial sector.

You can engage with these experts to gain deeper insights into their financial decisions, discuss various scenarios, and receive guidance tailored to your unique situations.

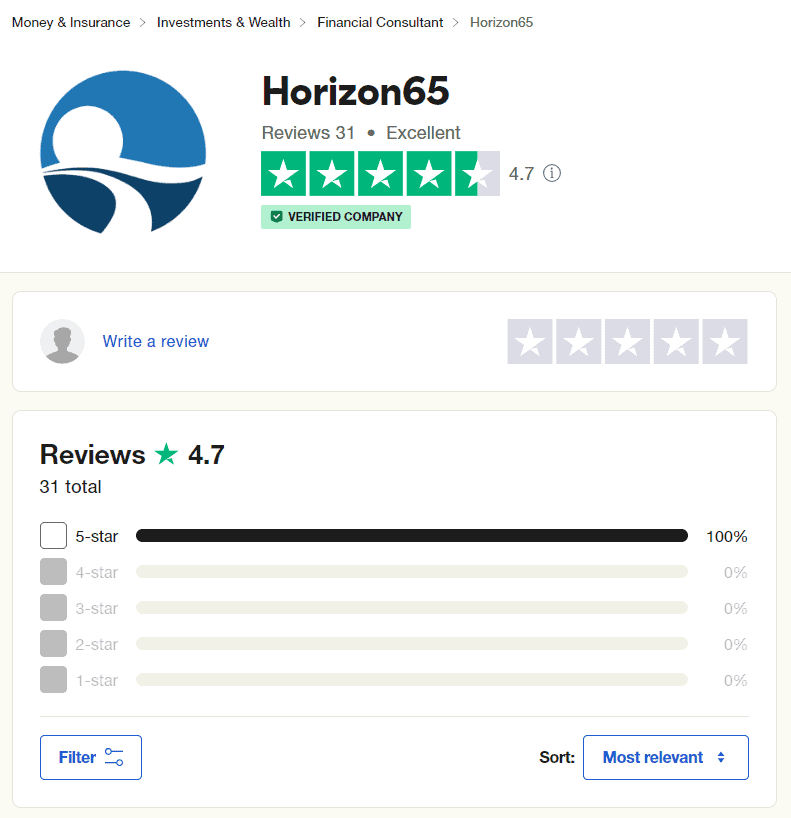

What Others Are Saying

Horizon65 has received a wave of positive feedback from clients who have experienced firsthand the clarity and support it offers in the often-confusing retirement planning journey. Users repeatedly praised the service for its practical approach to what many find challenging and turn the uncertainty of how much to save and what to expect from pensions into a clear, actionable plan.

Clients frequently commend the user-friendly nature of Horizon65. They, particularly those unsure how to start saving for retirement, recognize the service and appreciate its straightforward and accessible approach. Its ability to project the future value of savings is a feature that many have found invaluable and got a tangible glimpse into the long-term impact of their financial decisions.

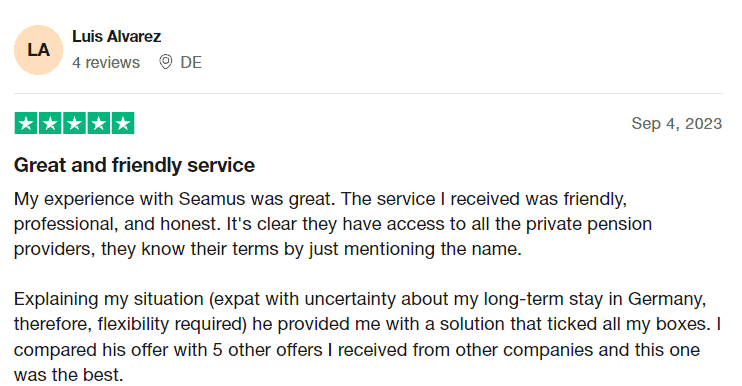

The individual advisors at Horizon65, like Fionn, Seamus, and Ziad, often appear in customer reviews for their approachable and reliable service. Clients appreciate the personal touch by noting that their advisors made complex financial discussions feel comfortable and easy to understand.

Horizon65’s commitment to providing personalized advice tailored to each client’s unique situation is another aspect that consistently earns praise. The service is notable for its comprehensive understanding of different pension plans and its ability to present suitable and optimal options for each client’s specific needs and circumstances.

Trust is a recurring theme in client testimonials, as the clients frequently highlight the transparency and sincerity of advice from Horizon65. Clients actually mentioned to be feeling confident and reassured in their decisions.

The absence of pressure or sales pitches, especially during the free consultancy sessions, is particularly appreciable as well. It demonstrates Horizon65’s focus on genuine guidance over business transactions.

Pricing

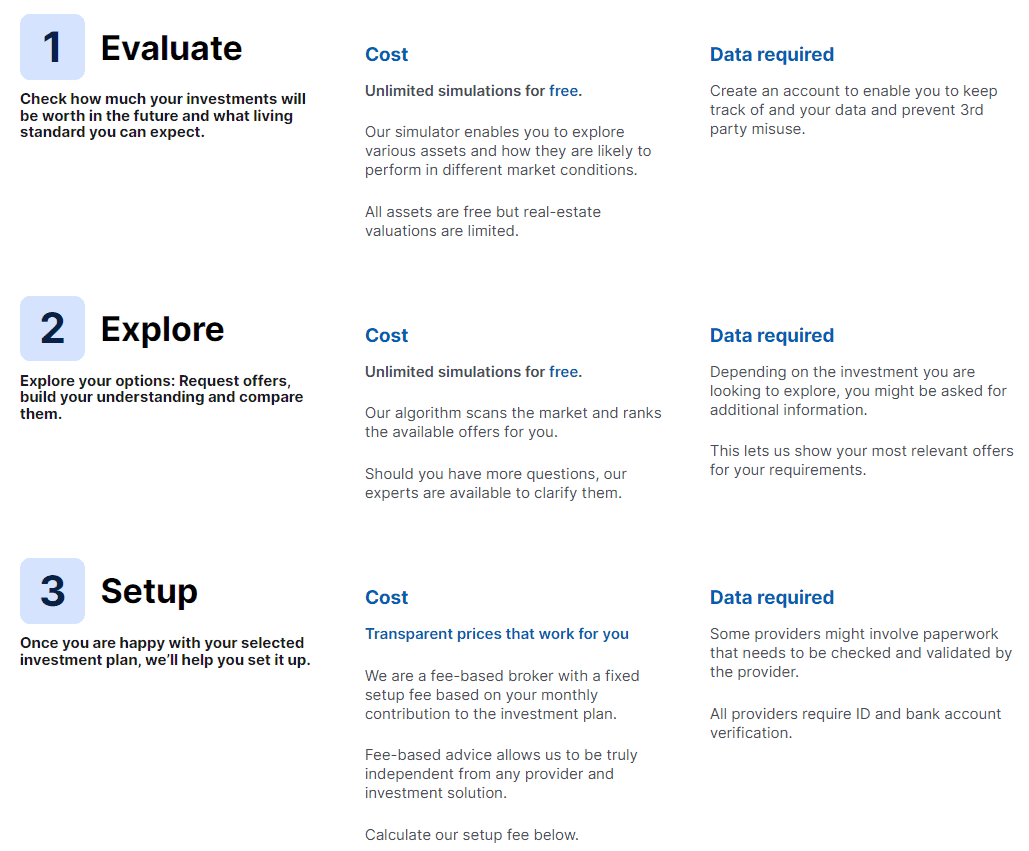

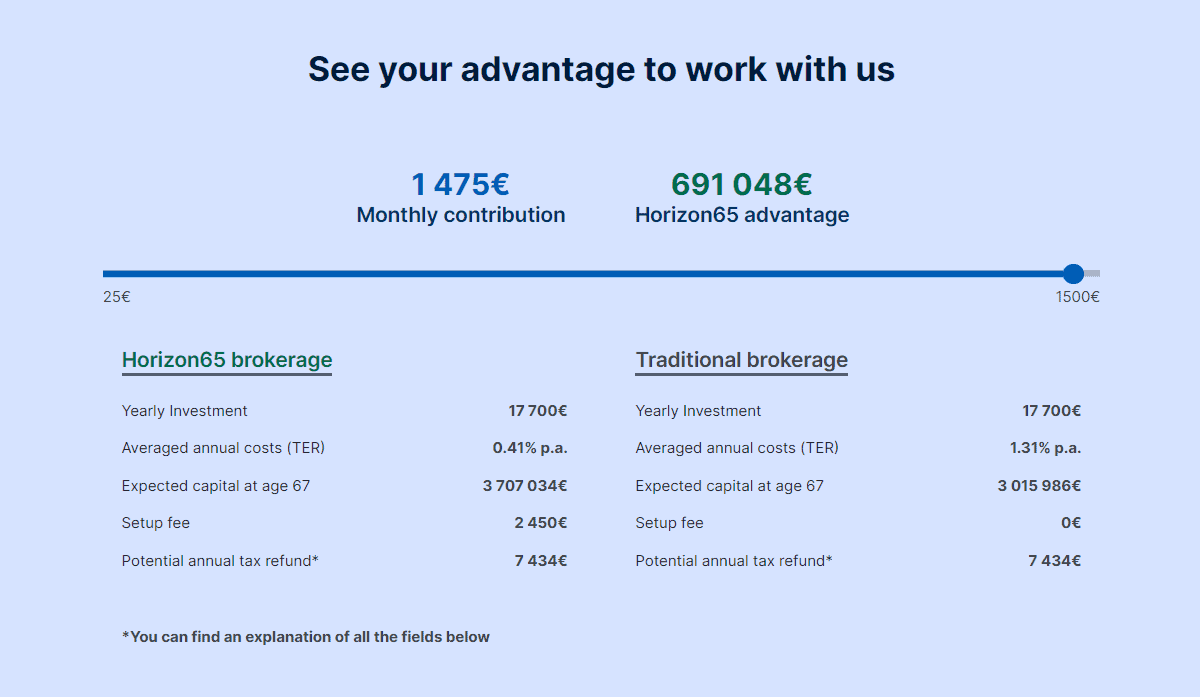

Horizon65 offers a clear and client-focused pricing strategy that emphasizes value and transparency. The initial stages of the service, including unlimited investment simulations and market offer explorations, are free. Although real estate valuations are limited, all other asset and market option evaluations are free to encourage users to take advantage of them as much as possible.

The setup of selected investment plans involves a transparent and fixed setup fee of 2,450€ for investment plan initiation. You can integrate the setup fee into initial payments or cover it through commission-based contracts. Even if you have issues paying this upfront fee, you can also get access to commission-based contracts that have an effective cost below 1% for most providers.

For those unable to afford the setup fee, Horizon65 provides alternative traditional brokerage options. These options also leverage top-notch technology to recommend plans with potentially 20% higher outcomes than others.

This multifaceted model of Horizon65 upholds its passion for delivering personalized, high-value financial solutions that actually work for you.

Final Thoughts

Horizon65 has quickly become an essential part of my financial planning toolkit to transform my approach to securing my financial future in Germany.

I have got around half of my whole tax charge as reimbursements to minimize the effective tax amount. It leverages policies to significantly reduce my effective tax burden, which, in turn, bolsters my savings and investments.

Its simulation tool and personalized investment options are top-notch features that give the platform an advantage in catering to you better. Its in-house professionals have provided bespoke advice that goes beyond generic financial guidance. They’ve helped me understand how to structure my investments and bypass tax complexities.

For anyone serious about securing their financial future, especially in the complex investment landscape of Germany, Horizon65 is worth exploring.

Full Disclosure: If you click on some of the links in this article and purchase a paid plan, I may receive affiliate commissions (at no cost to you!). Regardless, the products and services I review are some of the best I’ve tried, and I support them personally. Head over to my privacy policy & affiliate disclosure to know more.