Look, I was also confused, Germany finally has some good insurance, but which one to choose? You see ads, and you’re confused. So, I tried it and talked to many friends to figure out the right insurance. Spoiler alert, it depends on your preference and the number of insurances you need.

The conventional insurance industry has long been associated with complex paperwork, lengthy processes, and a lack of transparency. However, the rise of insurance tech companies has transformed the insurance landscape.

Traditional models are making way for innovative insurance companies that leverage cutting-edge technology and user-centric approaches to redefine how insurance is experienced.

Among these pioneers, Getsafe, Feather Insurance, and Lemonade stand out as frontrunners, each offering a distinctive approach to simplifying and enhancing the insurance process.

In this article, I delve deep into these three industry disruptors – Getsafe, Feather Insurance, and Lemonade – to compare their offerings, explore their unique features, and help you navigate the evolving world of insurance solutions.

But before we dive into the review, an important note: This article is not financial advice or recommendation but my personal experience with Getsafe and Feather Insurance. The information provided in this article is only for informational purposes and should not be considered insurance advice. Please research and ensure you fully understand the risks involved.

Again, full transparency: I may receive commissions if you click on some of the links in this article, but it won’t cost you a thing! Also, the companies do not pay me to write these reviews. I test the products and services myself, and I support them regardless.

Table of Contents

Feather Insurance – The One With the Best Reviews (+Expats Friendly)

If you’re looking for insurance solutions designed with expatriates in mind, Feather Insurance emerges as a guiding light, offering a unique blend of customized coverage and digital convenience.

Feather operates as an insurance intermediary, connecting expatriates with a curated selection of insurance offerings that cater to their unique circumstances. As MGA Feather operates like an insurance company and is in full control of the entire user experience. (This differs from a traditional insurance broker that is just referring you to other companies as a middleman).

Expats often face distinct challenges when finding coverage that aligns with their needs, and this is where Feather Insurance steps in. By offering a range of insurance products, including health, liability, household, and travel insurance, Feather ensures that expatriates can access a comprehensive suite of coverage options tailored to their requirements. On top of that many of their insurance plans are portable within the EU and globally making it convenient in case of a move to another country.

However, being an intermediary means dealing with another party to ensure your insurance policies are set in stone.

Language barriers can often hinder the insurance experience for expatriates. Feather Insurance acknowledges this challenge and bridges the gap with its English-language support.

By offering customer service in English, Feather ensures that expats can comfortably access information, receive assistance, and navigate the intricacies of insurance in their preferred language.

Feather Insurance recognizes the modern expat’s affinity for digital solutions. With a fully digital platform, Feather brings the entire insurance journey – from policy purchase to claims processing – to the fingertips of its customers. This digital accessibility empowers expatriates to manage their coverage seamlessly, regardless of location, providing a sense of control and convenience. Feather has also recently launched an app, making digital management of your insurance policies even easier!

One of Feather Insurance’s defining characteristics is its unwavering commitment to transparency. Feather’s pricing structure is straightforward and understandable, ensuring that expatriates understand what they are paying for. This transparency fosters trust, allowing ex-pats to engage with their coverage confidently.

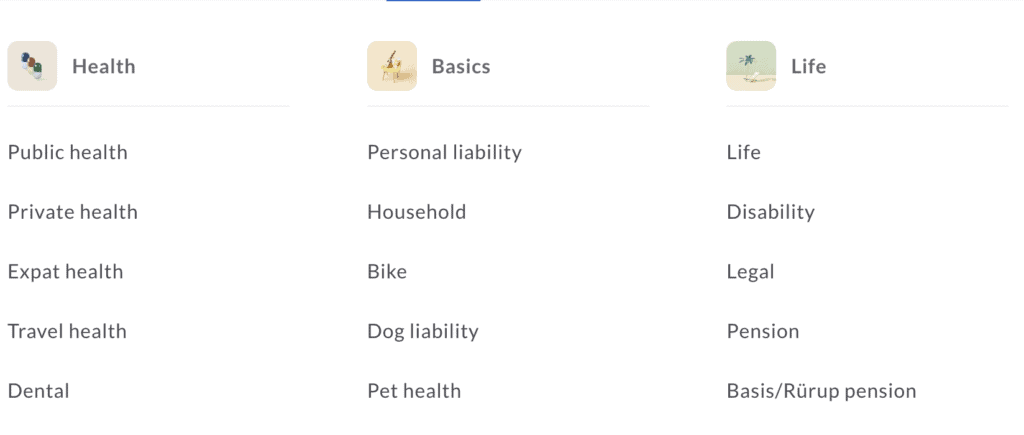

Feather could be your one-stop shop for all insurance & life products such as:

Update 2024

I have a newsletter for expats in Munich, I am learning that Feather Insurance is more expat friendly, they have way fewer people complaining about their claims and English friendly. Insurance is all about post-purchase experience, and it seems like Feather is doing a great job at it.

Pros

- Tailored Coverage for Expats: Feather Insurance stands out for its specialized focus on expatriates in Germany. By offering a range of insurance products – from health and liability to household and travel insurance – Feather ensures that expatriates can access coverage that aligns precisely with their circumstances.

- Language-Friendly Support: Recognizing the language barriers that expatriates often face, Feather Insurance offers customer service in English. This language-friendly approach ensures that expats can confidently communicate, seek assistance, and navigate the complexities of insurance.

- Digital Accessibility: Feather Insurance’s digital platform brings the convenience of insurance management to expatriates’ fingertips. From policy initiation to claims processing, expats can effortlessly navigate their coverage requirements, regardless of geographical location.

- Transparency and Trust: Feather Insurance upholds transparency as a cornerstone. Their straightforward pricing structure ensures that expatriates understand their insurance costs clearly, fostering trust and allowing them to engage confidently with their coverage.

Cons

- Limited Geographic Focus: Feather Insurance’s specialized approach caters primarily to expatriates in Germany, While they are currently expanding their services to Spain and France. This limited geographic focus might be a drawback for expats seeking tailored insurance solutions in other countries. This can also be beneficial because when a company dedicates itself to a specific region, it can concentrate more effectively on serving its customers.

Unique Features

Let’s take a look at the unique features of Feather Insurance.

Tailored Coverage for Expats

Feather Insurance is a dedicated insurance solution for expatriates. It offers a range of coverage options, including health, liability, household, and travel insurance, specifically designed to address the needs and circumstances of expats living in Germany. This tailored approach ensures that expatriates access coverage that aligns perfectly with their situations.

Digital Accessibility

Feather Insurance leverages technology to enhance accessibility. Expatriates can conveniently manage their insurance journey from anywhere through its digital platform. From purchasing policies to filing claims, the digital interface provides a user-friendly and efficient way for expatriates to handle their coverage requirements.

Intermediary Insurance for Broader Coverage

Feather Insurance acts as a bridge between expatriates and a curated selection of insurance offerings. By operating as an intermediary, it offers expatriates a variety of coverage options from different providers, allowing them to choose the insurance that best suits their individual needs.

Advice and Support

Feather Insurance goes beyond mere policy provision by offering valuable advice and support. Expatriates often have unique insurance-related queries and concerns, and Feather’s expert guidance ensures they make informed decisions about their coverage options.

These distinctive features collectively position Feather Insurance as an insurance solution that is not only tailored to your needs but also responsive to the challenges you may face while navigating insurance in a foreign country.

Give Feather Insurance a shot, and let them handle all your insurance needs. You can check out my full Feather Insurance review for a more detailed breakdown of its features and pricing!

Getsafe – High on Transparency and Trust

Getsafe emerges as a beacon of simplicity, empowerment, and trust in this evolving insurance landscape. Unlike traditional intermediaries, Getsafe strides ahead as a direct provider, redefining how insurance is accessed, understood, and embraced.

At the heart of Getsafe’s philosophy lies a commitment to transparent and accessible coverage. This commitment is mirrored in their diverse offerings, spanning home, contents, legal, dental, and liability insurance. Despite their diverse offerings, Getsafe currently lacks travel insurance.

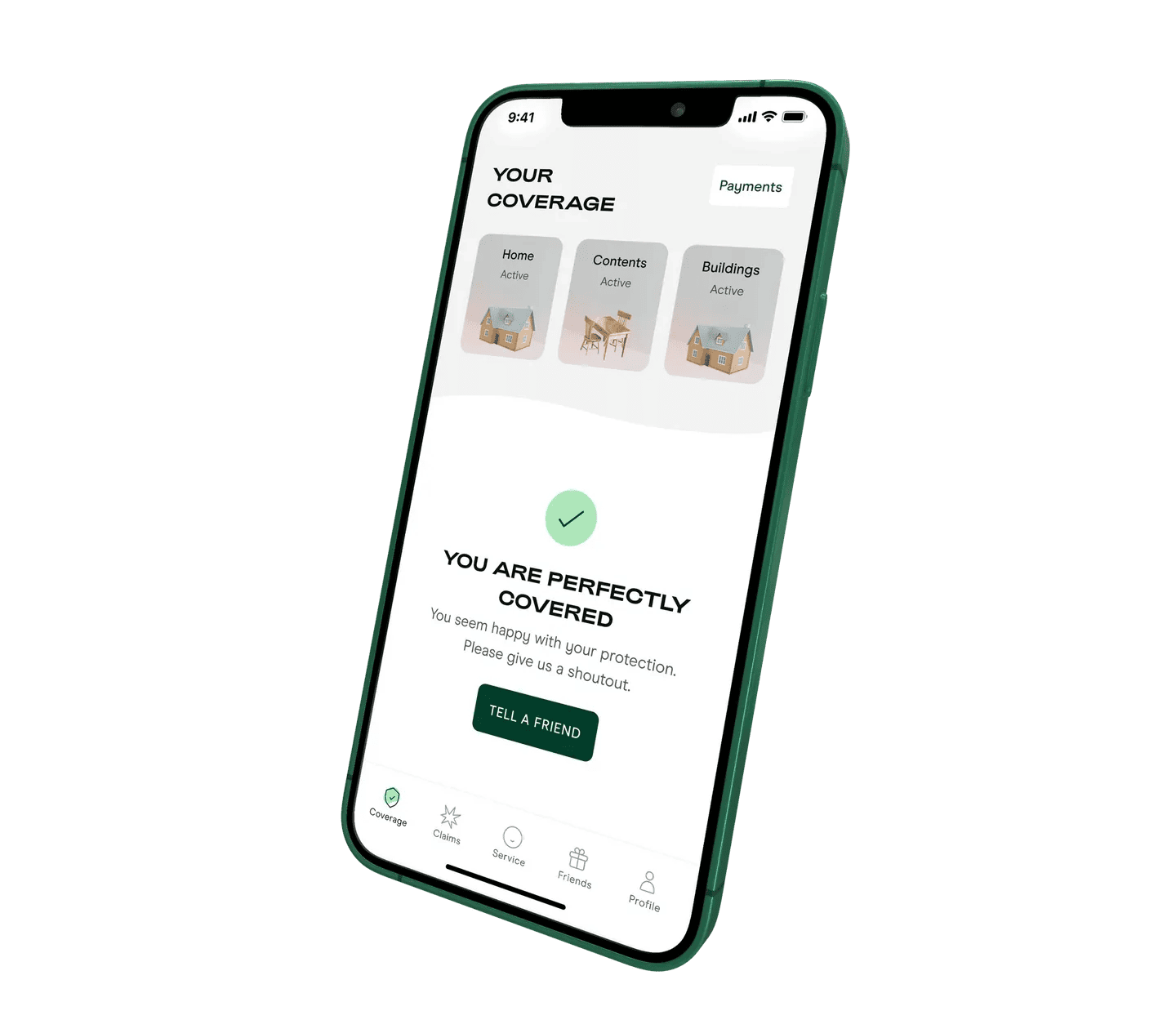

With Getsafe, the complexities that accompany insurance dissolve into a streamlined digital experience. The mobile app also provides a seamless journey from policy selection to claims management at your fingertips.

Getsafe’s unwavering dedication to customer-centricity extends to its modular insurance approach. This empowers users to tailor their coverage, ensuring their policies align with their needs and circumstances. No longer a maze of jargon and uncertainty, insurance becomes a tool for personal empowerment.

Pros

- Direct Approach: Getsafe’s direct model eliminates the middleman, ensuring customers have a direct line to their insurance provider. This results in a streamlined experience, reducing potential miscommunication and enhancing overall efficiency.

- Transparency: Getsafe’s commitment to transparency is fresh air in the insurance industry. The company’s open communication about policies, terms, landing pages, and pricing fosters trust, allowing customers to make informed decisions confidently.

- Modular Insurance: Getsafe’s modular approach empowers customers to tailor their coverage to their needs. This flexibility ensures that individuals only pay for what they need, making insurance more personalized and cost-effective.

- Wide Array of Offerings: Getsafe’s versatile portfolio of insurance products, from home and contents to legal and liability insurance, caters to diverse needs.

- Seamless Digital Experience: With a mobile app that serves as a digital hub for all insurance-related tasks, Getsafe brings convenience to the forefront. Policy management, claims filing, and updates are just a tap away.

- Customer-Centric Approach: Beyond technology, Getsafe’s customer support shines. The company balances the digital realm with personalized assistance, offering everything in English and ensuring customers have a human touch whenever they need guidance or help.

- BaFin Backing for Added Confidence: Getsafe’s credibility is further underlined by its backing from BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht), the German Federal Financial Supervisory Authority.

- English Support Tailored for Expats: Getsafe offers full end-to-end English support for expats in Germany, ensuring a seamless experience.

Cons

- Reviews could be better: Getsafe operates as an insurance provider, not just a middleman or broker. This means they carefully assess and sometimes deny claims that don’t hold up, leading to some complaints about their reviews. As a result, they currently have an average rating of 4.0, a bit lower than some others in the same field. I also see in their ads that some people are unhappy.

Unique Features

Here are some of Getsafe’s most significant features.

Personalized Modular Approach

Getsafe’s approach to insurance is incredibly customized. The company stands out by offering a modular framework that allows policyholders to piece together coverage that precisely matches their requirements. This customized approach provides a sense of empowerment and ensures that individuals are neither overinsured nor undercovered.

Direct Connection, Transparent Interaction

Unlike conventional insurance intermediaries, even some digital ones like Feather Insurance, Getsafe establishes a direct link between the policyholder and the provider. This direct interaction fosters a heightened level of transparency and trust as customers engage with the source of their coverage without the layers of ambiguity that intermediaries may introduce.

Seamless Digital Management

Getsafe’s mobile app transforms how individuals manage their insurance. From policy inception to claims handling, the app serves as a central hub, granting policyholders the convenience to navigate their coverage requirements at their own pace and time, all with just a few taps.

Empowered Customer Choices

Getsafe’s approach to insurance transcends traditional boundaries by putting the power into customers’ hands. By offering a broad spectrum of insurance products, ranging from home and contents to travel and liability coverage, Getsafe ensures that customers can select policies that align perfectly with their unique circumstances.

Try Getsafe today and discover a new level of personalized insurance experience. You can check out my full review for a more in-depth breakdown of Getsafe’s features.

Lemonade Inc. – Limited to property & casualty

Lemonade Inc. seamlessly blends cutting-edge technology with a distinctive social mission. Lemonade embarked on its journey in 2015, driven by a bold vision to revolutionize insurance from a mundane necessity to a force for societal good. Its niche focus on Property and Casualty (P&C) insurance sets Lemonade apart, a unique stance complemented by its expansive global reach.

While some insurers offer a broad spectrum of coverage types, Lemonade zeroes in on renters’, homeowners’, car, pet, and term life insurance. This focus allows Lemonade to offer tailor-made solutions within this domain.

Where Lemonade truly stands apart is in the expanse of its geographical footprint. Compared to Getsafe and Feather Insurance, which cater to specific markets, Lemonade boasts a more extensive reach.

Its technologically advanced platform is accessible to customers within the United States and spans various European markets, including Germany, the Netherlands, and France. This global scale empowers Lemonade to impact a diverse range of customers, making its unique insurance approach available on a much broader canvas.

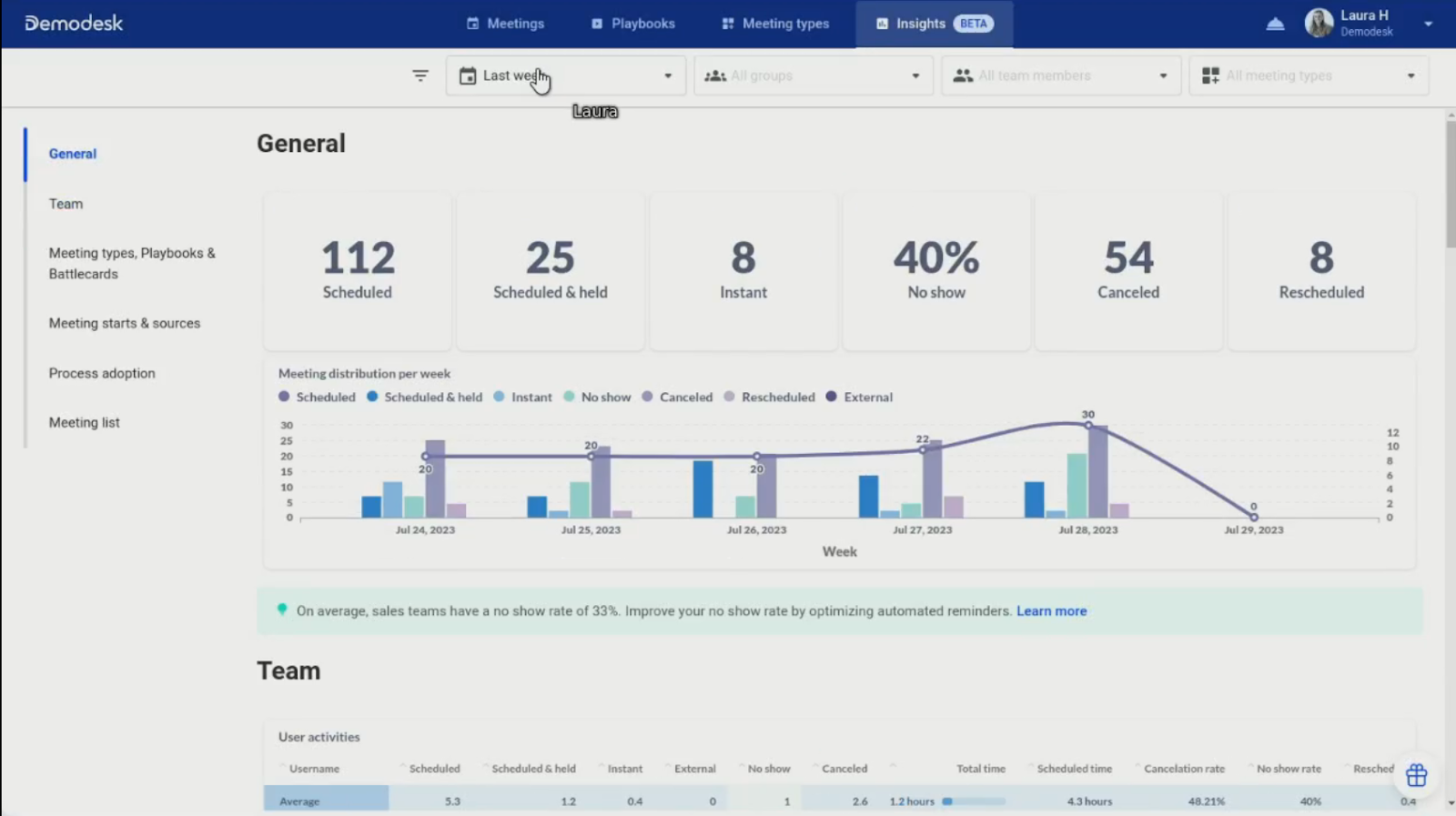

Lemonade’s distinct identity also lies in its effective utilization of artificial intelligence (AI). By harnessing AI-driven solutions, Lemonade streamlines a multitude of insurance processes, right from swift policy quotations to the remarkably efficient resolution of claims.

Beyond enhancing customer experience, Lemonade’s technological prowess translates into its distinctive “Giveback” initiative. Under this program, Lemonade allocates unused premiums to charitable endeavors, a heartwarming gesture that intertwines insurance with the broader cause of social welfare.

Pros

- Almost Global Geographical Presence: Lemonade enjoys a widespread presence across multiple countries, including the United States and various European markets. This extensive reach allows a diverse range of customers to access its unique insurance solutions.

- Innovative AI-Powered Platform: Lemonade’s innovative use of artificial intelligence streamlines the insurance process, offering swift policy quotes and efficient claims resolution.

- Social Impact with “Giveback” Initiative: Lemonade’s “Giveback” program sets it apart by donating unused premiums to charitable causes chosen by its customers.

- Transparent and User-Centric: Lemonade’s transparent pricing and user-friendly policies align with its commitment to providing a clear, straightforward insurance experience.

Cons

- Limited Variety of Coverage Types: Lemonade’s concentration on P&C insurance results in a narrower range of coverage options. Individuals or families seeking insurance solutions that extend beyond P&C insurance might find their options constrained.

Unique Features

Let’s glance at Lemonade’s most unique features.

Global Footprint Beyond Borders

Lemonade’s expansive geographical reach transcends conventional market boundaries. Unlike Getsafe and Feather Insurance, Lemonade’s technologically advanced platform extends its offerings to the United States and diverse European markets, including Germany, the Netherlands, and France.

Innovative AI-Driven Efficiency

Lemonade stands out through its innovative utilization of artificial intelligence (AI). This cutting-edge technology powers swift policy quotes and rapid claims resolution, propelling insurance processes into a realm of efficiency and convenience.

P&C Specialization Redefined

Lemonade’s specialization in Property and Casualty (P&C) insurance is a defining attribute that sets it apart. While some insurers offer a broad spectrum of coverage options, Lemonade’s strategic focus on areas like renters’, homeowners’, car, pet, and term life insurance enables it to master these niches.

Final Thoughts

Each solution – Getsafe, Feather Insurance, and Lemonade – brings unique strengths to the table, catering to diverse needs.

While each solution has merits , Feather Insurance is a reliable intermediary centered around helping expatriates, making it suitable for expats who appreciate guided navigation through insurance complexities. Find out more from Feather Insurance’s website! Update 2024 tells me that Feather is THE OPTION to go for now.

On the other hand, Getsafe emerges as an option, combining direct simplicity with a commitment to trust and transparency. The direct approach and a vast array of insurance solutions make Getsafe unbeatable in its quest to make insurance accessible and understandable.

The only limitation might be its availability in only four markets. Yet, if you find yourself within these markets, the choice becomes clear: Getsafe offers an unparalleled avenue to navigate the intricacies of insurance with confidence and ease.

Lemonade’s expansive global footprint makes it an excellent choice for those seeking border coverage. However, it might fall short if your insurance requirements extend beyond Property and Casualty (P&C).

Ultimately, the crown goes to Feather Insurance for their overall great experience with expats and great post-purchase experience.

Full Disclosure: If you click on some of the links in this article and purchase a paid plan, I may receive affiliate commissions (at no cost to you!). Regardless, the products and services I review are some of the best I’ve tried, and I support them personally. Head over to my privacy policy & affiliate disclosure to know more.